To listen to an audio version of this article, please press the play button above.

————————————————————————————————————————————

Let’s start with answers to the questions posed in the previous article.

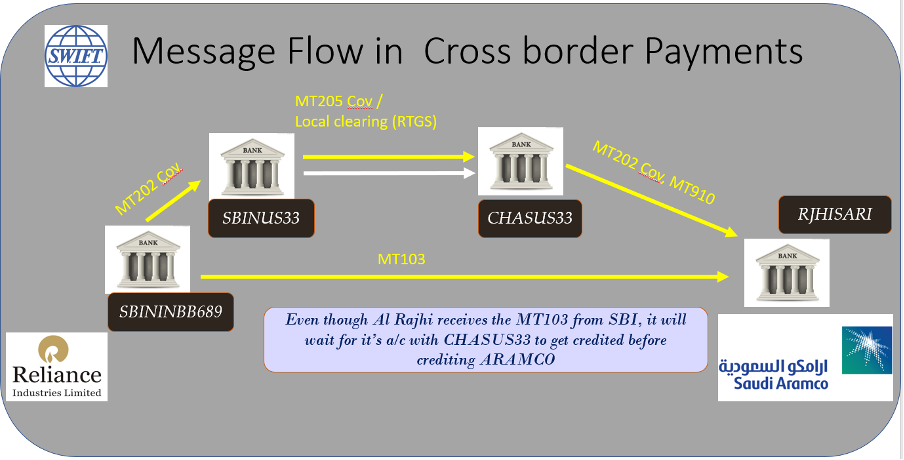

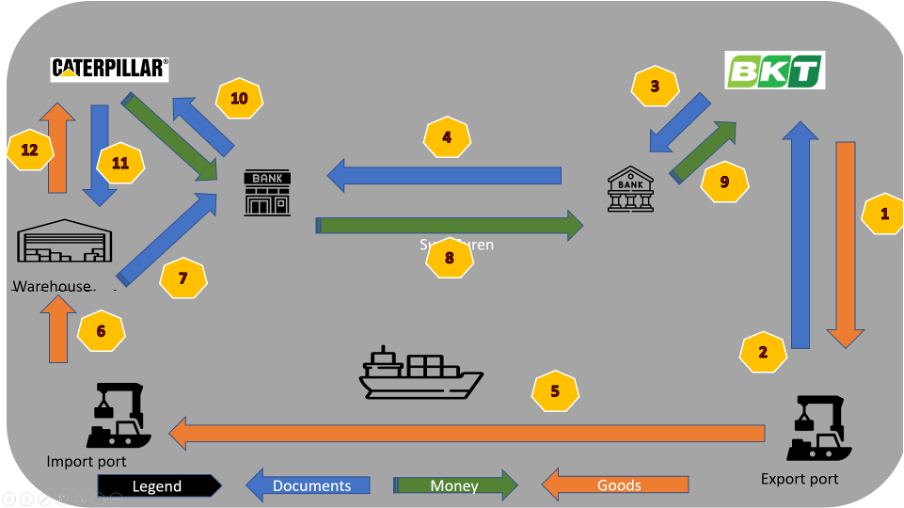

Q1: In this entire chain of cross-border payment transaction- where a company in India paid a company in Saudi Arabia, in which leg did the money actually move?

A: Money actually moved from one bank in the US to another in US. It did not cross any border!

But wasn’t this supposed to be a cross border payment? Money from India to Saudi?

Indeed! But because the payment was in USD, the transfer happened between two NOSTRO accounts in the US itself.

But what crossed borders, if money didn’t?

Messages! Yes just messages went beyond borders.

So if Adam Savage (of the popular TV show “Mythbusters”) were to investigate this, he would proudly proclaim – Busted!!

Contrary to popular perception in cross border payments, money doesn’t cross borders, only messages do.

But the companies in India and Saudi didn’t have USD accounts, they had INR and SAR accounts. Surely there must have been some conversion that must have happened?

Yes, that’s brings us to question no 2.

Q2: Where exactly did the currency conversion from INR to USD or USD to SAR happen?

In their respective countries.

INR- USD was done by SBI Mumbai and USD -SAR was done by AL Rajhi bank, Riyadh.

The banks in US don’t determine the exchange rate for any of the legs of this particular transaction.

Q3: Which countries’ compliances and regulations had to be applied in this transaction?

It is easy to guess that the compliance of governments in India and Saudi Arabia apply to these transaction as the buyer and seller are in these respective countries.

But here is the kicker. Just because the payment passes through banks in US, the compliance rules of the Govt. of the US of A also apply to this transaction.

If we zoom out of this single transaction and have a satellite’s eye view (a bird wouldn’t have so much of a span for our purposes), since most international trade happens in USD, ALL (yes all!) of those transactions have to comply with the rules of the Govt. of US of A.

-we can say that, just because USD is the world’s popular trade currency, central banks around the world buy and store it as a major reserve currency, thereby increasing the demand for USD perennially.

-the US govt is able to apply it’s writ on international transactions between two random foreign entities that are thousands of miles away from the shores of US, despite the fact the goods don’t come anywhere near the US.

Is this a good thing or a bad thing? Depends!

Depends on where you stand or how friendly one or both of the trading countries are with the US of A.

Let’s take just two examples to see the impact of this.

FATCA. Citizens of almost all countries around the world had to declare their FATCA status with banks around the world. Why? Because the US govt said unless each bank (called an FFI – Foreign Financial Institution) in every country collected and reported relevant data to the US on their FATCA status, US govt will withhold 30% of the value of bank’s qualifying (this is a subset of all txns) transactions going through US, done for FATCA non-compliant customers living in a foreign country. Considering almost all major banks around the world need to have USD NOSTRO accounts with banks in US, they have no choice but to comply.

FATCA (Foreign Asset Tax Compliance Act) is a US law since 2010 to track the income from the foreign assets of US citizens, living and maintaining accounts abroad. These assets could be Savings or fixed deposits in banks, Mutual Funds, Insurance products, real estate etc. As an example, if a US citizen has an account in Italy, the US govt wants to know. While most govts ask their citizens to declare their foreign assets and income voluntarily, the US govt goes one step further. It asks the banks’ and financial institutions of other countries to report, if any of the accounts they service for their customers, are for US citizens. To know this, the banks need to ask ‘every’ account holder to give a declaration of their US citizenship status.

With the US Dollar’s unique position of being an international trade currency, US was able to enforce compliance on every financial institution in 90 countries of the world, for an internal tax program. Who bears the operational costs and inconvenience of this compliance? – the respective banks. Who will the banks recover this cost from? Their respective customers. So here is an internal tax compliance program of the US govt, being paid for and complied with, by citizens of other countries around the world.

The second example is what happened as part of sanctions on Russia following the Ukraine-Russia war. US was able to successfully stall all (well, almost all) international trade if one of the trading partners was a Russian entity.

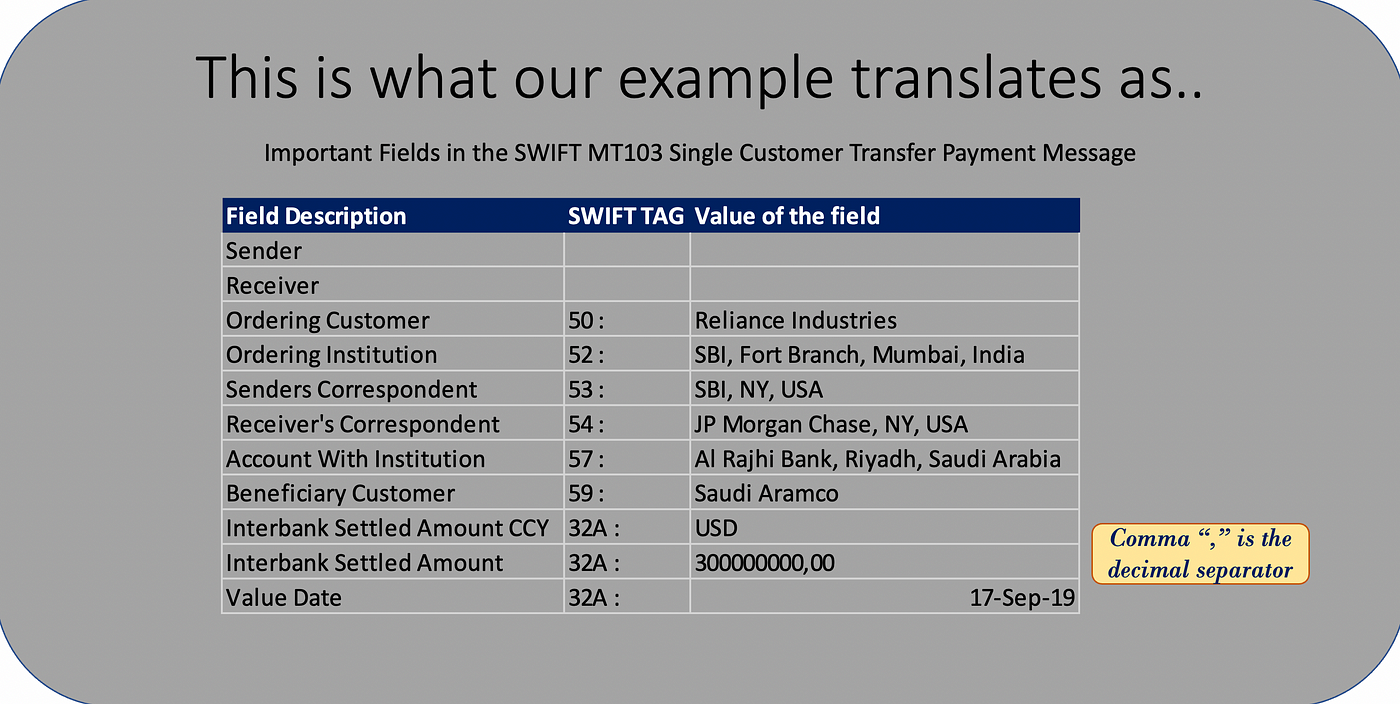

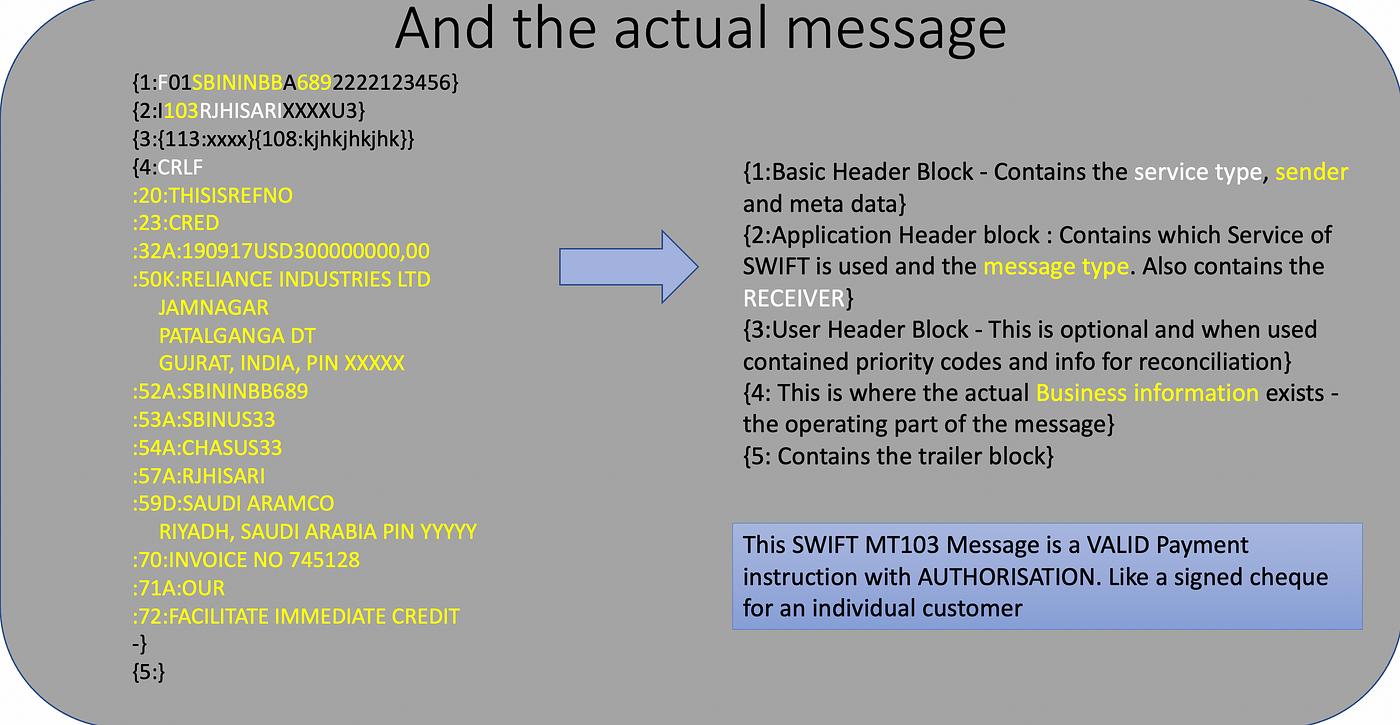

How is this even possible? Recall the organisation and messaging platform called SWIFT? And that it is owned by banks across Europe and US. (you can read more about SWIFT here). Also, if you recall the details of the SWIFT message in this article, you will know that every SWIFT payment message contains information on who originated the payment and who the beneficiary is. Combined with the fact that each USD transaction will have to go through banks in the US, it is easy for banks in the US to know who are the entities in an international transaction. As a result, the enforcement of this ban was quick, because US banks had a switch to identify and kill transactions, if one of the trading parties was Russian.

We need not get into the merits of the war or the sanctions. But if you look at it purely from a risk manager’s point of view, any country is at risk of immediate suspension of its international trade if they fall out of favour of the US. In that sense, the kill switch to the world’s international trade is in the hands of a few western nations.

Isn’t this a risk for other behemoths of international trade? like say – China? Yes and that’s why they try to wean away their international transactions from USD and are promoting Yuan based transactions. Or even trade based on bilateral currencies between China – Saudi Arabia, China- Iran, China- Russia (that’s no surprise). But it is not easy, because it is not just in the realm of economics or trade, but a matter of geo-political dominance. This game has had its players and many haven’t lived to tell their story.

There has been a recent challenger to this – albeit a tiny one- having some acceptance across countries, including the USA. You must have heard about Bitcoin and its cousins. These are & will be limited to miniscule, marginal, esoteric or arcane transactions and will not enter the mainstream as a force to reckon with.

But a bigger challenger is on the slow brew. The war that has already started in eastern Europe, and more wars that are about to start, are a reaction to it. Lets cover that in the next article.

Click on the urls below the images below to view the previous and next articles in this series

Leave a Reply