Reading up on the previous article will give you a better context to understand this article.

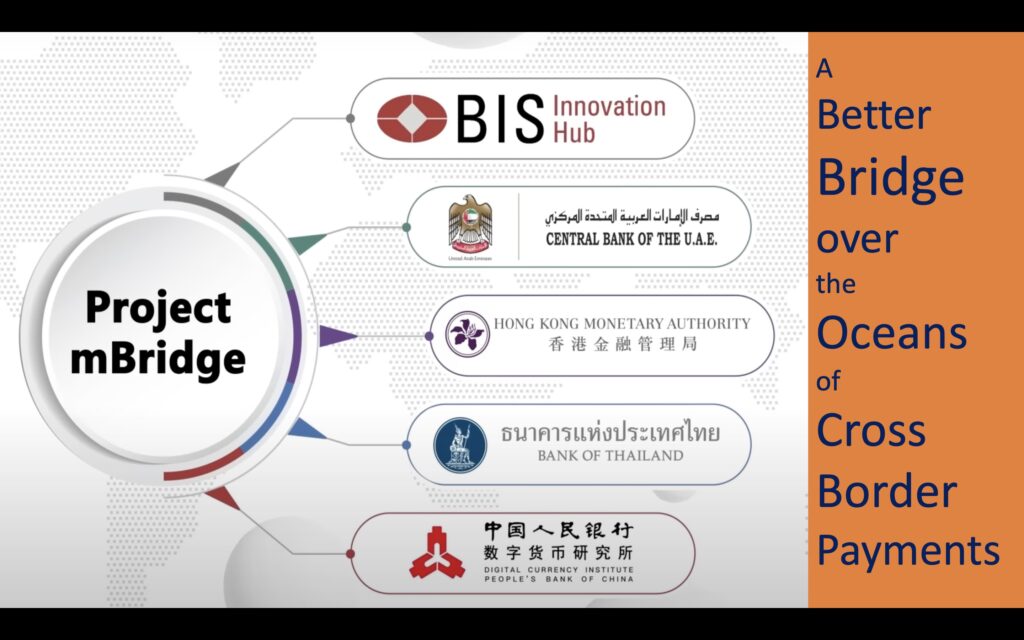

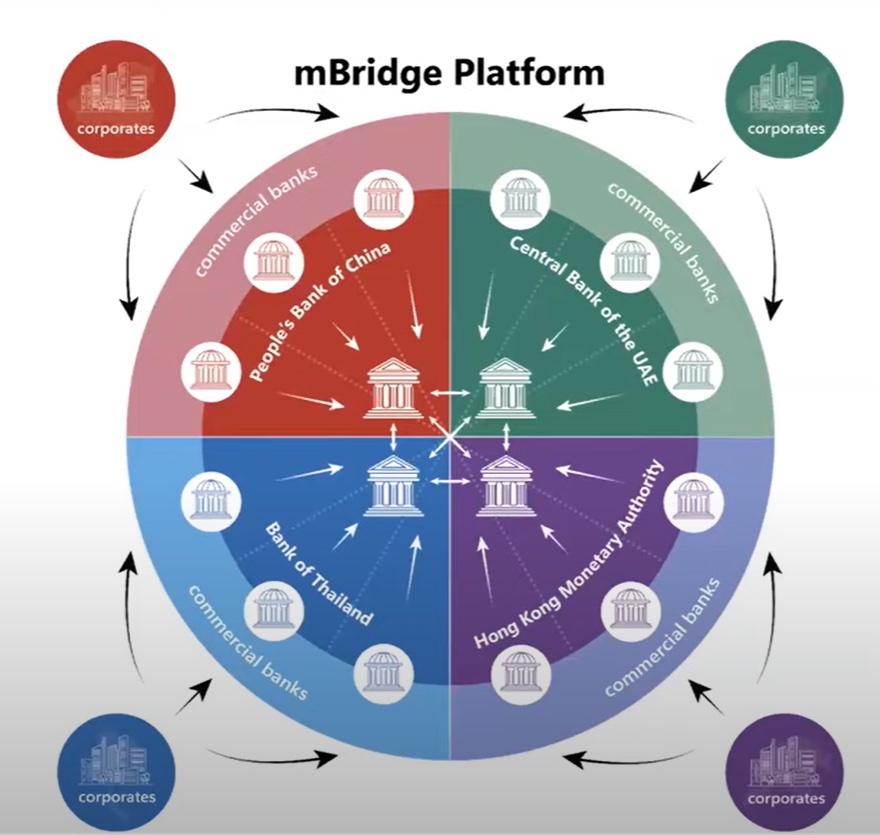

The Innovation Hub of Bank for International Settlements did a pilot phase of Project mBridge in Oct 2022 with the central banks of Thailand, UAE, China & Hong Kong to settle real transactions (i.e real world business transactions and not merely a test). A platform based on a new blockchain – the mBridge Ledger – was built by central banks to support real-time, peer-to-peer, cross-border payments and foreign exchange transactions using Central Bank Digital Currencies (CBDCs).

Ok lets cut to the chase. How do we understand mBridge payment mechanism with an analogy?

Think of UPI.

For readers outside India who are unfamiliar with UPI, this is India’s Instantaneous payment mechanism. A super-fast, super-convenient immediate end-customer settlement mechanism that brings cash like finality. It is app based and works at a monstrous scale that processes 10 billion transactions a month.

In UPI, both the sender and receiver of the payment have an app. They both have a unique identifier called UPI ID that is linked to their bank accounts. When the sender wishes to send money to the receiver, he opens the app, inputs the receiver’s UPI ID, fills in the amount and authorises the payment with a password. Bingo, the amount is instantaneously credited to the receiver, who also gets a notification on her device. Payment is complete and is final.

In mBridge, a similar thing happens but between banks that participate in the mBridge network.

To participate in the mBridge system, each bank needs to have a digital version of their country’s money a.k.a CBDC.

How do they get that? By exchanging regular money (paper or bank account) with their central bank & getting digital money of the same value. Banks can do the opposite too, redeem their CBDC for regular money.

Then comes the most important transaction of cross border payment.

Say, when one of the corporates in Thailand wants to send 1 million THB to a supplier in UAE, they simply perform a single one way payment transaction to the bank of the supplier. Just like a UPI transaction.

If you observed carefully, there are three important differences in this transaction from the present-day cross border mechanism. (read about the present day cross border payment mechanism here)

(a) No NOSTRO account was involved.

(b) No SWIFT message was sent

(c) Money ACTUALLY CROSSED borders, unlike in today’s practice where only messages cross borders.

The 1 million THB is now credited into the wallet of the UAE bank that received the payment for further credit to their end customer.

And all this happens in less than a minute as compared to about 2 days it takes in the correspondent banking system. Simply because there aren’t a chain of banks that need to be involved.

But behind the scenes there are a few additional steps that the central banks take to ensure risk management – just like in UPI. But at this introduction stage, lets keep it simple from an end customer point of view.

The mBridge set-up (see footnote 1) is such that the central banks have the ability to monitor in real-time, the transactions happening in its jurisdiction and in the currencies it has issued. It also has the ability to set, monitor and enforce transaction limits & balance limits – .i.e how much the banks can hold in their respective wallets. But once the payment is made, it is final. No one can reverse or cancel the transaction – just like UPI.

The third type of transaction mBridge allows is ingenuous and is a real game changer for banks. Say HSBC bank in HongKong performs an FX contract to buy 10 million RMB from Agricultural Bank of China (in China) by paying 10.7 million HKD. This is a transaction where one party has to pay another party RMB and receive HKD in return. In the present NOSTRO based correspondent banking system, because the HKD balances and RMB balances lie in two different banks in two different countries, each bank pays their obligation and hopes the other party also lives up to its end of the bargain. There is no way to ensure the other party pays up. Just in case the other bank doesn’t pay up (for various reasons), the one that paid up first, loses their money. This is well recognised in banking community as “Settlement Risk” [or Herstatt Risk after the infamous German bank that failed to pay up its obligations setting a series of heartaches across the world].

In one fell swoop, mBridge eliminates this risk. Using smart contracts, both legs of the transaction, i.e. HSBC HongKong paying 10.7 million HKD and Agricultural Bank of China paying 10 million RMB are “tied” to one another as conjoined twins. So when each bank initiates their transaction in this FX transaction type, mBridge will NOT execute it unless the other bank has also initiated the second leg of the transaction. While in blockchain parlance it is called an “Atomic” transaction, mBridge calls this as PvP – Payment vs Payment transaction. I.e. both legs “together” make a single transaction. This feature eliminates (not just reduce) settlement risk and hence the overall cost of transaction (in risk capital / risk management processes / insurance etc.) for all parties. Sweet, isn’t it?

In summary, the below picture tells us the three main transaction types mBridge currently supports.

Now let’s see the overall benefits mBridge offers.

- The Platform works on Central Bank money issued on Ledger and not on any arcane blockchain token. This not only makes the central bank guarantee the value of money, but also avoids pricing differences as CBDC behaves like a stablecoin (i.e a blockchain token having a fixed exchange rate with a traditional currency).

- The mBridge platform can be integrated with the respective countries’ local payment systems like RTGS / NEFT in the same currency reducing transaction costs.

- The use of locally issued CBDC also ensures compliance with jurisdiction-specific policy, legal requirements, regulations and governance needs of the central bank in its country.

- Allows offshore money. I.e allows currency issued by one country to reside in another country. In our first example, THB went from Thailand to UAE. Once the transfer was complete, THB was really held by a bank in UAE in a wallet. In today’s world of correspondent bank based payments, money doesn’t cross borders at all – despite the moniker “cross border payments”.

- 24 X 7 Settlement finality. The mBridge platform is designed to work 24 X 7 and each payment is final.

- Atomic Payment vs Payment. I.e. Both legs of the transaction settle together eliminating settlement risk.

- mBridge claims the settlements happen within 2 seconds including consensus in the pilot. This may not hold when more participants onboard on to the platform. But even if it takes an hour, it is much better than the 2 days in the current mechanism.

- The simpler transaction process, lesser time to transfer money & more importantly, the much lower cost of transaction will help all of us common people, who need to remit money across shores – either for business or personal reasons.

All this looks like a magic pill to end all the ills of the correspondent banking system, but we need to remember that before being rolled out across the world, central banks and governments across the world need to agree on jurisdiction, governance & legal matters.

To my mind, the powers that be will bring in a common legal character to this cross border payment mechanism with its own judicial system. This would end the hegemony of a set of countries that have a tight grip over current system. So it is likely it might be some time before mBridge gets implemented across the world. But the pace of implementation of CBDCs across the world shows the world is building financial infrastructure at a good pace to participate in such projects. That makes the prospects bright.

Take for instance India. The Reserve Bank of India launched CBDCs for both retail (for use by individuals) and wholesale (for use by banks & treasuries) use since Nov 2022. Several individuals and organisations have opened their CBDC accounts for eRupee, although transactions haven’t picked up except in random retail transactions and government bonds settlement. Now RBI has mandated a pilot to settle call money transactions between banks in CBDC from Oct 2023. Such progressive expansion into interbank transactions within the country will get banks accustomed to CBDC settlements. We will continue to watch the progress in CBDC use both in domestic and international transactions. That progress will sure be a subject of discussion in our next article. Until then…

Notes & References

Footnote 1: The CBDCs are blockchain based wholesale CBDCs (to be used between banks) and uses a permissioned consensus protocol. This is for blockchain aficionados. The rest of us can pretend we didnt read this.