Let’s see at a high level how an international transaction happens. This time, we will use the most popular commodity transaction -oil — in our illustration.

The trade:

In our example, the largest private sector refiner in India — Reliance Industries Ltd. (RIL hereafter) buys oil from Saudi Aramco of Saudi Arabia (we will refer to this as Aramco from here on). RIL banks with SBI, Fort branch, Mumbai and Aramco with Al Rajhi bank in Riyadh.

Most oil in the world gets sold in USD for the various reasons we saw in this article. Which means both buyer and seller will have to necessarily settle through a bank in US of A, irrespective of where they are. In our case, even though the seller is from Saudi Arabia and the buyer is from India, and the oil they exchange will never touch the shores of US of A, the commodity is priced in USD.

We can recall that the transaction will most likely be under the “letter of credit” and will involve the below parts.

LC Process: Before placing an order with Aramco, RIL will approach SBI to “Open” an LC favouring Aramco. Aramco will furnish it to its bank Al Rajhi and ask if the LC is trustworthy. If Al Rajhi is not comfortable with SBI’s trustworthiness or if their bilateral limits are exhausted, Al Rajhi can ask another bank to “confirm” SBI’s trustworthiness. By confirming this LC, this intermediate bank (say Citibank Riyadh) acts as a guarantor for SBI.

Since the transaction is to exchange Oil for Money, there are two Settlements. Since we have already seen the goods settlement in detail in the previous article (linked here), we will see how the money settlement happens in more detail here:

Goods settlement: When the ship calls on the port and unloads to the customs’ warehouse / oil farm, RIL, by sending an “acceptance” through SBI, gets the title for goods in the port / and lifts the goods. The payment terms can be on “Sighting” the goods — i.e pay the money and take the goods, or agree to pay x days after “accepting” to pay. The payment terms are as agreed upfront between the trade partners RIL & Aramco.

Money settlement: Since the transaction is in USD and as both SBI Mumbai and Al Rajhi, aren’t present in USD settlement zones, both of them need correspondent banks in the US of A to settle their transaction.

What are correspondent banks? These are banks where other banks maintain accounts — most often in a foreign country and in the currency of that country. So in our example, let’s say SBI Mumbai’s USD correspondent bank is SBI New York and Al Rajhi’s is JP Morgan Chase NY. By design these correspondent banks will be in US of A because that is where USD settlement happens. This correspondent relationship is not a transient one for ‘a’ particular transaction but are pre-established relationships between banks for long term. In fact, correspondent banks are listed publicly in a bank’s website and also figure in directories bankers use among themselves.

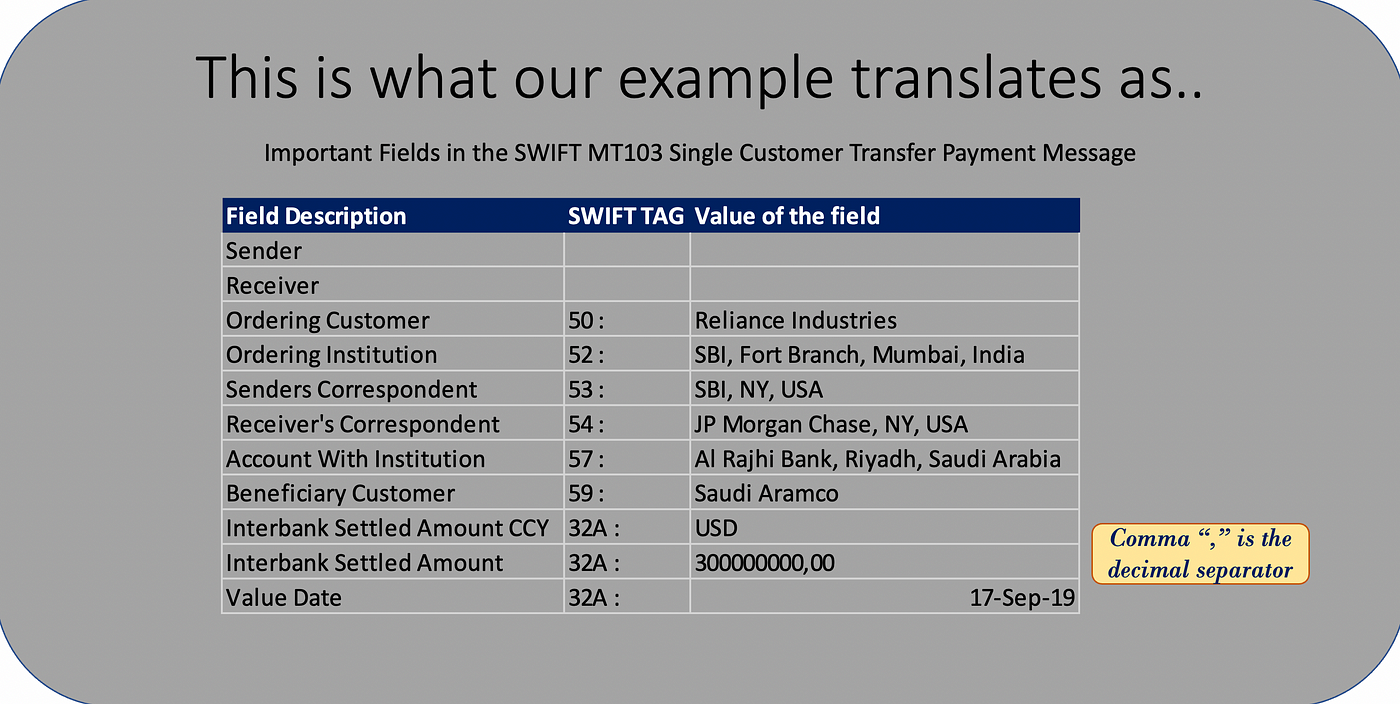

Now, back to our transaction. Here are the different parties in payment parlance. Note the banks are identified with their SWIFT BIC (Bank Identification Code, a unique code for each bank + branch combination, which will direct the SWIFT messages to them, like an email is sent to an email address)

• Ordering Customer (the one who initiates the Payment): Reliance

Industries

• Ordering Institution (the bank that sets in motion the payment process within the banking system): SBI, Fort Branch, Mumbai SBININBB689

• Beneficiary of the Payment: Saudi Aramco, Saudi Arabia.

• Account With Institution (the bank where the beneficiary holds an account): Al Rajhi Bank, Riyadh, RJHISARI

• Sender’s Correspondent (the USD correspondent of the bank that sends the payment message): SBI New York, SBINUS33

• Receiver’s Correspondent (the USD correspondent of the bank that receives the payment message): JP Morgan Chase New York CHASUS33

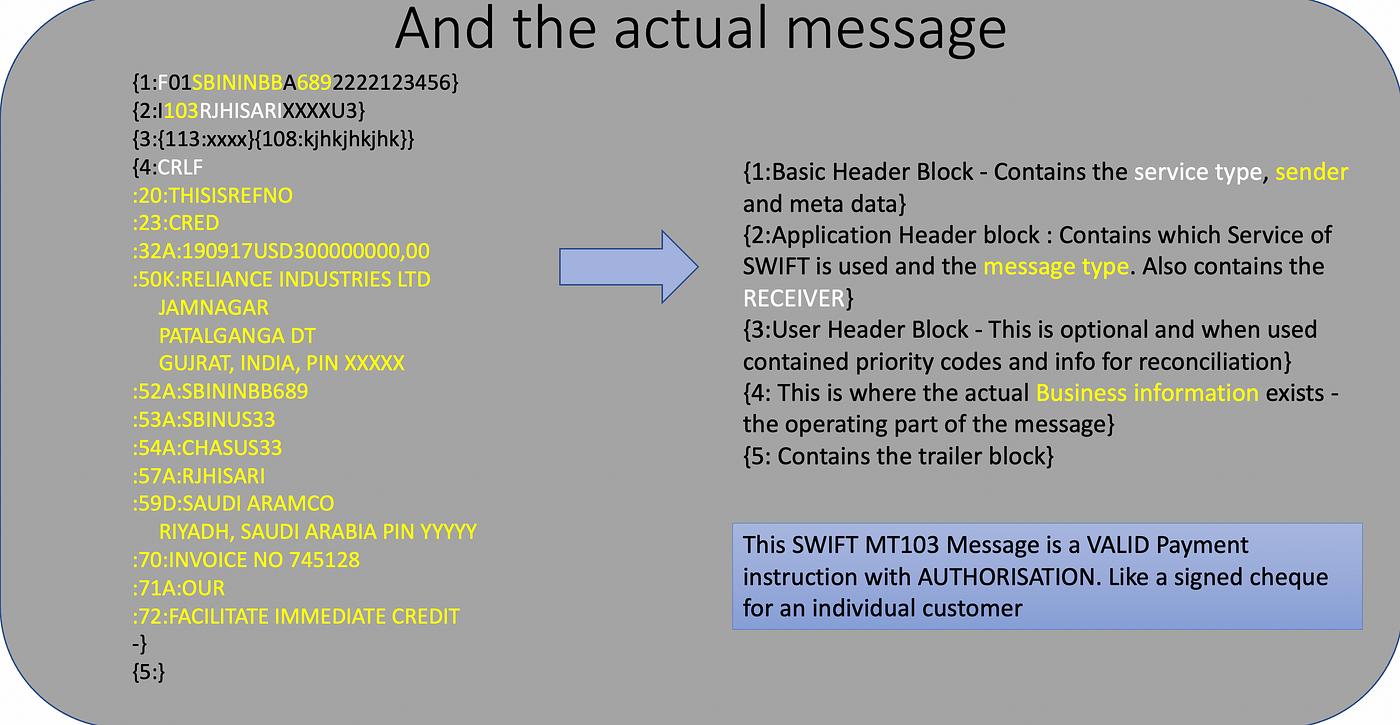

Each of these parties are identified in specific slots (called TAGs) in the respective SWIFT messages. For example the MT 103 message in our example will look like this.

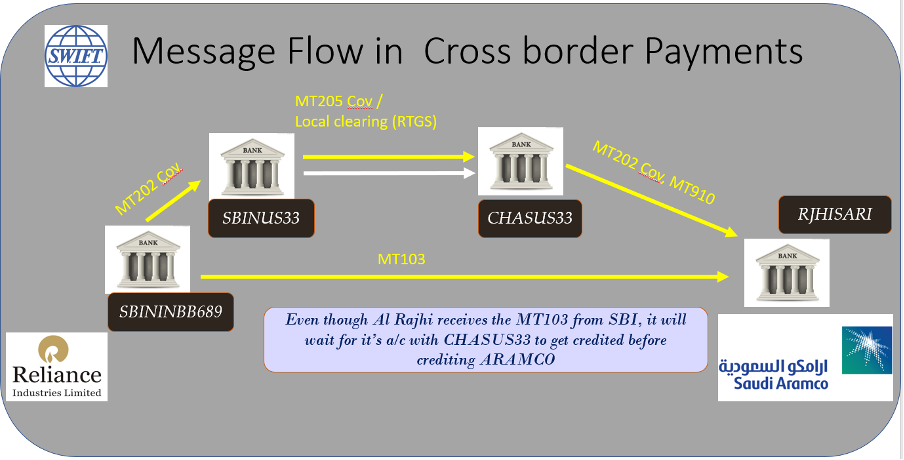

When RIL asks SBI Mum to pay, say USD 300 Mn to Aramco’s a/c held with Al Rajhi, Riyadh, the payment will happen like this.

1. SBI Mum (SBININBB689) will send a (SWIFT MT103) message to Al Rajhi (RJHISARI) saying that it is arranging payment through

the mentioned correspondent banks and that is against specific invoice number 745128. This MT 103 is a “Customer payment message”. Which means there is a customer on behalf of whom the payment is initiated.

2. SBI Mum will “inform” SBI New York (SBINUS33) through SWIFT MT 202COV to pay Al Rajhi’s a/c with JP Morgan Chase New York, with specific account number details.

Couple of clarifications here:

How would SBI MUM know who is Al Rajhi’s USD correspondent

or even the account number? Aramco would have shared this with RIL, which in-turn would relay it to SBI MUM. Even without Aramco telling them, the USD correspondent would be available in commercially available directories in the market that all banks subscribe to. These are like the yester-year telephone directories that give the different correspondent banks of most banks in the world in each currency.

What is this MT202COV? It is a message type to be used when a bank instructs its correspondent bank in a foreign country to move funds from its own account, to complete a customer payment it initiated. This type of payment mechanism is called the ‘Cover” method and hence the “COV” next to the message type MT202.

Banks send similar messages to their correspondents for their own purposes as well. In such cases they will simply use the message type MT202. I elaborate this to highlight how robust the SWIFT system is, which covers different scenarios of business and in-turn promotes its wide-spread acceptance, automation and even

standardisation. To this date, SWIFT is the de-facto platform for transactions among banks across borders.

3. With the above information, SBI NY will transfer the funds to JPMC in the local clearing in US — either CHIPS or FEDWIRE. To inform JPMC that this is an intermediate step in an international payment emanating from India and that both SBI NY and JPMC NY are just cogs in this wheel of international payment, SBI NY will relay the payment details through a SWIFT MT 205 COV message.

MT205 is similar to MT202 except that 205 is sent between banks when the currency of transfer is a local currency for both the banks. Since USD is the local currency in US where SBI NY and JPMC NY operate, MT205 is used.

Now we come to the last leg.

4. Once Al Rajhi sees a credit in its account with JPMC, meant for Aramco, they will pass on the credit to Aramco. Else they will wait for a confirmation message from JPMC. This can come as another set of SWIFT messages — MT 202 COV or a Credit advice (called an MT 910).

Only after this we can say the transaction can be said to have been “settled” i.e the cross-border payment transaction is said to be complete!

The reason I explained the above in detail is to set you thinking. Let me

leave you to ponder over the below questions.

- In this entire chain of cross-border payment transaction- where a company in India paid a company in Saudi Arabia, in which leg did the money actually move?

- Where exactly did the currency conversion from INR to USD or USD to SAR happen?

- Which countries’ compliances and regulations had to be applied in this transaction?

Once you have had time to think and have some responses, I will cover the answers and the impact in the next article.

Photo Credit: Thanks to chukovskaya on Pixabay

Very detailed flow of Trade. Thanks for sharing your knowledge.

[…] of how a trade between Saudi Arabia and India had to comply with the rules of USA as explained in this […]

[…] If you observed carefully, there are three important differences in this transaction from the present-day cross border mechanism. (read about the present day cross border payment mechanism here) […]