Now that we understand the need for trust and how “Letters of Credit” (we will call this LC from here on) bridge the trust deficit among (relatively) unknown trade partners, let’s get into the mechanism of how they work.

Let’s carry on with the previous example of our fictitious trade between Caterpillar & BKT tyres.

Once CAT and BKT find each other suitable (for the transaction that is 😁 ), they enter into a contract that will determine

– what type of tyres BKT is selling, its technical specifications

– the quantity

– price,

– what does that price include (just the products, or freight & insurance too)

– where will it be delivered (at CAT’s location or is it sufficient if BKT delivers it to someone outside its own factory)

– when the tyres will be shipped / delivered

– how will the trade be carried out (through LC)

– which banks will be involved and who pays the fees

– how many days does CAT get to make the payment once the invoice is served

– any inspections to be done by a third party at the port where the tyres will be offloaded?

– Anything else they both (CAT & BKT) agree on.

So, in a sense, each and every foreseeable part of the transaction will be committed in the contract — including unforeseeable “force majore” clauses.

Now with this contract in hand, CAT will go to its bank (lets call it BofA, short for Bank of America) and ‘Open” an LC favouring BKT.

BKT receives this LC through its bank — say SBI- State bank of India. SBI performs a very important task here. It:

(a) Validates if the LC is genuine and is indeed issued by BofA (banks have a way of identifying each other, thanks to SWIFT).

(b) Advises BKT if BofA is a trustworthy / creditworthy bank. This is a little more complex activity, but for now we will pretend it is simple.

These are important steps, as the LC itself is an instrument that is meant to establish trust. If the issuing bank is not trustworthy, it beats the purpose. You would immediately understand what I mean if I mention CAT gets the LC issued by the Fifth Third Bank (yes, such a bank exists!). So, it is important for SBI to satisfy itself that the bank that opens the LC is indeed worthy of trust. If SBI is not able to directly establish trust, it can do so with some intermediary (called the “confirming bank”).

By doing so, SBI becomes the “advising bank” for BKT.

Now why would BofA or SBI take the trouble of doing all this for their customers? Fee income! but they will get into this business only after assessing the risk they are taking. So in a sense, the banks allow their customers to transfer risk on to them, thereby becoming trust providers.

To look at it another way, all the banks in the chain make money with LC fees. Remember, this is without lending a $, just by lending their trust (& of course managing the risk) banks make money. So this LC business -which you can see as “fee based” income in bank’s annual reports — is something banks fight for.

Let’s get back to the contents of the LC. CAT will ensure all the important conditions that are to be fulfilled are included in the LC terms & conditions for its bank to release the payment. It will include conditions like the type of tyres (Earthmax SR 47), quantity, type of packaging etc. If these conditions are met by BKT and verified by BofA, BofA will make a payment to SBI. (Did you notice that BofA is making the payment instead of CAT?).

Now, a question may pop up. Are banks equipped to validate the type of tyres? Are they qualified to ascertain the quality of materials used as per the specifications?

Banks service a wide customer base that would be dealing with a variety of merchandise. What if a pair of customers trade in chemicals; will the bank have the ability to tell what those chemicals are? Is this why bankers study chemistry in school? Or graduate in biology to validate the animal products shipped for their customers?

Thankfully, they don’t have to do all this. Banks will have to deal only with documents (without having to leave their airconditioned offices). Between trusted partners, a self-declaration by the exporter is sufficient to say what they are shipping but if an importer wants to be doubly sure, they can insist on a validation by an independent agency at the port of export, before goods are exported. They just have to ensure that this verification by the appropriate agency (identified upfront) is included in the LC conditions & a clearance certificate is one of the documents to be submitted to the issuing bank to claim payment.

Coming back to our CAT-BKT trade, all BofA has to do is, ensure BKT’s agent submits all the documents that are mentioned in the LC, with the desired contents. And if BofA is satisfied with the contents of the documents, it will release payment to SBI (for BKT).

But before that, let’s see what the steps in international trade under LC are, at a very high level.

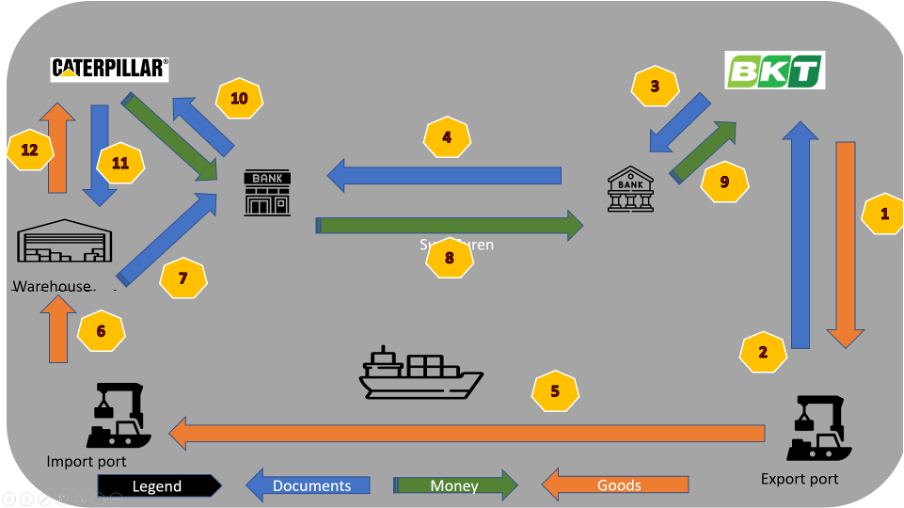

Consider the below picture, follow the numbers on the arrow for the sequence of steps. (This picture is AFTER both CAT & BKT have contracted with each other and BofA has also ISSUED the LC in BKT’s favour). In a sense the below is the actual flow of goods, documents and payments sequence. Arrows are colour coded.

Step 1: BKT sends the consignment of tyres to its freight forwarding agent, who will liaison with

(a) the export customs and get the necessary paperwork done,

(b) engage a shipping company that will take the tyres to Illinois, arrange to load them on to the ship.

(c) take out freight insurance.

Each of these entities will issue documents like export certificates, bill of lading, insurance policy etc.

Step 2: These documents are sent to BKT. The bill of lading is an important document that confirms that the shipping company has taken possession of the goods as described in the LC AND has loaded on to the ship headed towards where CAT wants.

Step 3: BKT hands over these documents to SBI, which verifies if these are as mentioned in the LC (if not, it will be iterated enough number of times to ensure they are as per the LC).

Step 4: SBI sends these documents to BofA to claim the payment.

Meanwhile, in parallel, the goods set sail to the destination port in Step 5: and are unloaded into the customs warehouse there (as in Step 6).

Step 7: All customs related procedures will be performed by CAT / its agent with the customs in the import country. Customs’ clearance & approvals are essential.

Step 8: Based on all documents (Bill of lading, Bills of exchange, Insurance, packing lists, certifications if any, etc.) that BofA has received, it takes a decision to accept or reject the payment and if accepted, they arrange to make payment to SBI as per the terms of the LC [could be immediate payment (called sight) or a deferred payment (usance)].

With this, two things happen.

(a) The transaction as per the LC is now complete from BKT / SBI point of view as their payment (or its assurance) is done. (Step 9)

(b) The title for the goods shipped are now transferred to CAT.

Step 10: All the documents that establish title to the goods and as required by the customs warehouse to release the possession of the goods are handed over by BofA to CAT, which can now share these documents to customs (Step 11) and receive the tyres (Step 12). Only at this stage CAT will get to lay its hands on the goods they purchased.

The payment terms between BofA and CAT are mutually agreed based on their relationship and upfront agreements. CAT can make the payment immediately to BofA or choose to convert the payment BofA made to SBI as a loan (much like ‘buy now pay later’), but this is between a customer and a banker as the international trade part is already complete.

BKT is happy that it received payment as long as it complied with the process and CAT is happy that payment was released only when its trusted banker verified all the documents are as per the LC conditions CAT jointly drafted.

Above is a simple flow and there are multivarious sub steps / complexities in each of the above steps. Our objective is not to get in deep but to have an overview of this process.

It is important to realise that all the communication between BofA, SBI and any banks in between are through the trusted network between banks — SWIFT.

Right from issuance of an LC to its lifecycle (issuance, additions, amendments, pre-advice, reporting discrepancies, acceptance or refusal, there are several types of messages under the MT700 series. MT stands for Message Type and each area is banking is covered by a series. 700 series (commonly written as MT 7xx) is dedicated for the LC type transactions.

Alongside, you would have also noticed (if not, please notice now), how a trusted messaging system is essential for the banking system to work and why it is important most banks in the world be part of it to move the wheels of the international trade machine.

We haven’t concluded yet as we are to see how the payment actually happens across borders. That, is a matter for our next article! See you soon.

Click on the urls below the images below to view the previous and next articles in this series